Official Voter Information Guide

OVERVIEW OF STATE BOND DEBT

PREPARED BY THE LEGISLATIVE ANALYST

This section describes the state's bond debt. It also discusses how the bond measures on the ballot (Proposition 13), if approved by voters, would affect state costs to repay bonds.

State Bonds and Their Costs

What Are Bonds? Bonds are a way that governments and companies borrow money. The state government uses bonds primarily to pay for the planning, construction, and renovation of infrastructure projects such as bridges, dams, prisons, parks, schools, and office buildings. The state sells bonds to investors to receive “up-front” funding for these projects and then repays the investors, with interest, over a period of time.

Why Are Bonds Used? A main reason for issuing bonds is that infrastructure typically provides services over many years. Thus, it is reasonable for people, both currently and in the future, to help pay for the projects. Also, the large costs of these projects can be difficult to pay for all at once.

What Are the Main Types of Bonds? The two main types of bonds used by the state are general obligation bonds and revenue bonds. One difference between general obligation bonds and revenue bonds is how they are repaid. The state repays general obligation bonds using the state General Fund (the state's main operating account, which it uses to pay for education, prisons, health care, and other services). The General Fund is supported primarily by income tax and sales tax revenues. The state repays revenue bonds from the General Fund but also from other sources, such as fees paid by users of the funded project (such as from bridge tolls). Another difference between state general obligation bonds and revenue bonds is how they are approved. General obligation bonds issued by the state have to be approved by voters, while revenue bonds generally do not.

What Are the Costs of Bond Financing? After selling bonds, the state makes regular payments typically over the next few decades until the bonds are paid off. (This is very similar to the way a family pays off a mortgage.) The state pays somewhat more for projects it funds through bonds than for projects it funds up-front because of interest. The amount of additional cost depends primarily on the interest rate and the time period over which the bonds have to be repaid.

State Spending on Bonds

Amount of General Fund Debt. The state has about $80 billion of General Fund-supported bonds on which it is making principal and interest payments each year. In addition, the voters and the Legislature have approved about $42 billion of General Fund-supported bonds that have not yet been sold. Most of these bonds are expected to be sold in the coming years as additional projects need funding. Currently, we estimate that the state is paying about $6 billion annually from the General Fund to repay bonds.

Propositions on This Ballot. There is one general obligation bond measure on this ballot. Proposition 13 would allow the state to borrow $15 billion for modernization and construction of preschool, K–12, and higher education school facilities.

This Election's Impact on Debt Payments. We estimate that the total cost (including interest) to pay off the general obligation bond measure on this ballot would be about $26 billion. This total would equal an average of about $740 million per year over the next 35 years, which is about 13 percent more than the state currently spends from the General Fund on its bond debt. The exact costs would depend on the specific details of the bond sales.

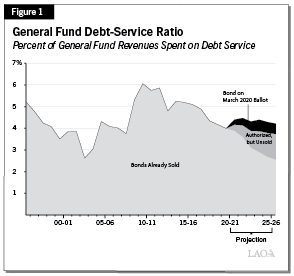

This Election's Impact on the Share of State Revenues Used to Repay Debt. One indicator of the state's debt situation is the portion of the state's annual General Fund revenues that must be set aside to pay for bond debt. This is known as the state's debt-service ratio (DSR). Because these revenues must be used to repay debt, they are not available to spend on other state programs, such as operating colleges or paying for health care. As shown in Figure 1, the DSR is now around 4 percent. If voters do not approve the proposed bond on this ballot, we project that the state's DSR on already approved bonds will grow over the next couple of years—peaking at about 4.1 percent in 2020–21—and then begin decreasing. If voters approve the proposed general obligation bond on this ballot, we project it would increase the DSR by less than one-half of one percentage point compared to what it would otherwise have been. The state's future DSR would be higher than shown in the figure if the state and voters approve additional bonds in the future.

Back to the Top

Back to the Top