California General Election November 6, 2018

Official Voter Information Guide

PROP

5

CHANGES REQUIREMENTS FOR CERTAIN PROPERTY OWNERS TO TRANSFER THEIR PROPERTY TAX BASE TO REPLACEMENT PROPERTY. INITIATIVE CONSTITUTIONAL AMENDMENT AND STATUTE.

ANALYSIS BY THE LEGISLATIVE ANALYST

BACKGROUND

Local Governments Levy Taxes on Property Owners. California local governments— cities, counties, schools, and special districts—levy property taxes on property owners based on the value of their property. Property taxes are a major revenue source for local governments, raising over $60 billion per year.

Calculating a Property Owner's Tax Bill. Each property owner's annual property tax bill is equal to the taxable value of his or her property multiplied by the property tax rate. The typical property owner's property tax rate is 1.1 percent. In the year a property is purchased, its taxable value is its purchase price. Each year after that the property's taxable value is adjusted for inflation by up to 2 percent. This continues until the property is sold and again is taxed at its purchase price.

Movers Often Face Increased Property Tax Bills. The market value of most homes (what they could be sold for) grows faster than 2 percent annually. This means the taxable value of most homes is less than their market value. Because of this, when a homeowner buys a different home, the purchase price of the new home often exceeds the taxable value of the buyer’s prior home (even when the homes have similar market values). This leads to a higher property tax bill for the home buyer.

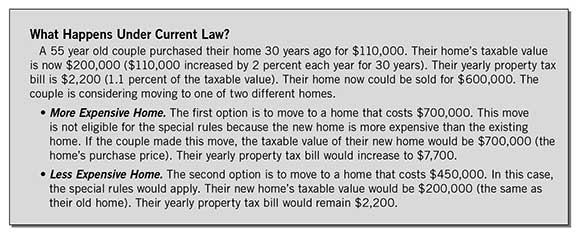

Special Rules for Some Homeowners. In some cases, special rules allow existing homeowners to move to a different home without paying higher property taxes. These special rules apply to homeowners who are over 55 or severely disabled or whose property has been impacted by a natural disaster or contamination. (We refer to these homeowners as "eligible homeowners.") When moving within the same county, an eligible homeowner can transfer the taxable value of his or her existing home to a different home if the market value of the new home is the same or less than the existing home. Also, a county government may allow eligible homeowners to transfer their taxable values to homes in the county from homes in different counties. Ten counties allow these transfers. Except in limited cases, homeowners who are over 55 or severely disabled can transfer their taxable value once in their lifetime. The nearby box ("What Happens Under Current Law?") has an example of how these rules work.

Other Taxes on Home Purchases. Cities and counties collect taxes on the transfer of homes and other real estate. Statewide, transfer taxes raise around $1 billion for cities and counties.

Counties Administer the Property Tax. County assessors determine the taxable value of property. Statewide, county spending for assessors' offices totals around $600 million each year.

California Taxes Personal Income. The state collects a personal income tax on income earned within the state. Taxable income can include profits from selling a home. The personal income tax raises over $80 billion each year.

PROPOSAL

Expands Special Rules for Eligible Homeowners. The measure amends the State Constitution to expand the special rules that give property tax savings to eligible homeowners when they buy a different home. Beginning January 1, 2019, the measure:

- Allows Moves Anywhere in the State. Eligible homeowners could transfer the taxable value of their existing home to another home anywhere in the state.

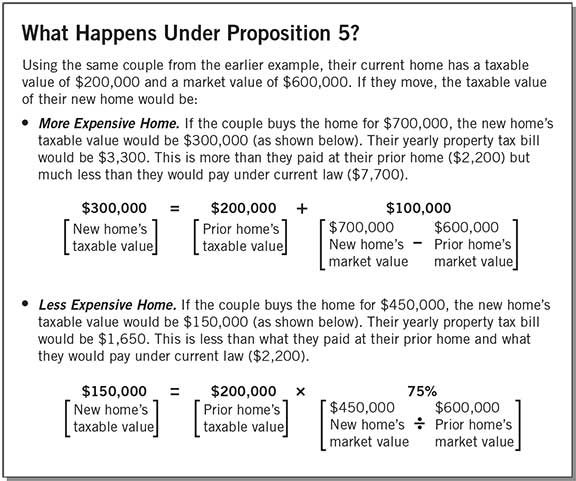

- Allows the Purchase of a More Expensive Home. Eligible homeowners could transfer the taxable value of their existing home (with some adjustment) to a more expensive home. The taxable value transferred from the existing home to the new home is adjusted upward. The new home’s taxable value is greater than the prior home's taxable value but less than the new home's market value. An example is shown in the nearby box ("What Happens Under Proposition 5?").

- Reduces Taxes for Newly-Purchased Homes That Are Less Expensive. When an eligible homeowner moves to a less expensive home, the taxable value transferred from the existing home to the new home is adjusted downward. An example is shown in the nearby box ("What Happens Under Proposition 5?").

- Removes Limits on How Many Times a Homeowner Can Use the Special Rules. There is no limit on the number of times an eligible homeowner can transfer their taxable value.

FISCAL EFFECTS

Reduced Property Tax Revenues to Local Governments. The measure could have multiple effects on property tax revenue:

- Reduced Taxes From People Who Would Have Moved Anyway. Right now, about 85,000 homeowners who are over 55 move to different houses each year without receiving a property tax break. Most of these movers end up paying higher property taxes. Under the measure, their property taxes would be much lower. This would reduce property tax revenue.

- Potentially Higher Taxes From Higher Home Prices and More Home Building. The measure would cause more people to sell their homes and buy different homes because it gives them a tax break to do so. The number of movers could increase by a few tens of thousands. More people being interested in buying and selling homes would have some effect on home prices and home building. Increases in home prices and home building would lead to more property tax revenue.

The revenue losses from people who would have moved anyway would be bigger than the gains from higher home prices and home building. This means the measure would reduce property taxes for local governments. In the first few years, schools and other local governments each probably would lose over $100 million per year. Over time, these losses would grow, resulting in schools and other local governments each losing about $1 billion per year (in today's dollars).

More State Spending for Schools. Current law requires the state to provide more funding to most schools to cover their property tax losses. As a result, state costs for schools would increase by over $100 million per year in the first few years. Over time, these increased state costs for schools would grow to about $1 billion per year in today's dollars. (This is less than 1 percent of the state budget.)

Increase in Property Transfer Tax Revenues. As the measure would increase home sales, it also would increase property transfer taxes collected by cities and counties. This revenue increase likely would be in the tens of millions of dollars per year.

Increase in Income Tax Revenues. Because the measure would increase the number of homes sold each year, it likely would increase the number of taxpayers required to pay income taxes on the profits from the sale of their homes. This probably would increase state income tax revenues by tens of millions of dollars per year.

Higher Administrative Costs for Counties. County assessors would need to create a process to calculate the taxable value of homes covered by this measure. This would result in one-time costs for county assessors in the tens of millions of dollars or more, with somewhat smaller ongoing cost increases.

Visit https://www.sos.ca.gov/campaign-lobbying/cal-access-resources/measure-contributions/2018-ballot-measure-contribution-totals/ for a list of committees primarily formed to support or oppose this measure. Visit http://www.fppc.ca.gov/transparency/top-contributors/nov-18-gen.html to access the committee's top 10 contributors.

If you desire a copy of the full text of the state measure, please call the Secretary of State at (800) 345-VOTE (8683) or you can email vigfeedback@sos.ca.gov and a copy will be mailed at no cost to you.

Back to the Top

Back to the Top