California General Election November 6, 2018

Official Voter Information Guide

OVERVIEW OF STATE BOND DEBT

PREPARED BY THE LEGISLATIVE ANALYST

This section describes the state’s bond debt. It also discusses how the bond measures on the ballot, if approved by voters, would affect state costs to repay bonds.

State Bonds and Their Costs

What Are Bonds? Bonds are a way that governments and companies borrow money. The state government uses bonds primarily to pay for the planning, construction, and renovation of infrastructure projects such as bridges, dams, prisons, parks, schools, and office buildings. The state sells bonds to investors to receive “up-front” funding for these projects and then repays the investors, with interest, over a period of time.

Why Are Bonds Used? A main reason for issuing bonds is that infrastructure typically provides services over many years. Thus, it is reasonable for people, both currently and in the future, to help pay for the projects. Additionally, the large costs of these projects can be difficult to pay for all at once.

What Are the Main Types of Bonds? The two main types of bonds used by the state are general obligation bonds and revenue bonds. One difference between general obligation bonds and revenue bonds is how they are repaid. The state typically repays general obligation bonds using the state General Fund (the state's main operating account, which it uses to pay for education, prisons, health care, and other services). The General Fund is supported primarily by income and sales tax revenues. The state often repays revenue bonds from other sources, such as fees paid by users of the funded project (such as from bridge tolls). Another difference between state general obligation and revenue bonds is how they are approved. General obligation bonds issued by the state have to be approved by voters, while revenue bonds do not.

What Are the Costs of Bond Financing? After selling bonds, the state makes annual payments over the next few decades until the bonds are paid off. (This is similar to the way a family pays off a mortgage.) The state pays more for a project funded by bonds than if the state does not borrow money for the project because of the interest costs. The amount of additional cost depends primarily on the interest rate and the time period over which the bonds have to be repaid.

Bonds and the State Budget

Amount of General Fund Debt. The state has about $83 billion of General Fund-supported bonds on which it is making annual principal and interest payments. In addition, the voters and the Legislature have approved about $39 billion of General Fund-supported bonds that have not yet been sold. Most of these bonds are expected to be sold in the coming years as additional projects need funding. Currently, we estimate that the state is paying about $6 billion annually from the General Fund to repay bonds.

Propositions on This Ballot. There are three general obligation bond measures on this ballot. Together, these measures would authorize the state to borrow an additional $14.4 billion:

- Proposition 1 would allow the state to borrow $4 billion for affordable housing and veterans-related programs. (Of this total, $1 billion would be for a veterans’ home loan program, which is expected to be repaid by veterans participating in the program rather than the General Fund.)

- Proposition 3 would allow the state to borrow $8.9 billion for water and other environmental projects.

- Proposition 4 would allow the state to borrow $1.5 billion for certain hospitals that treat children.

In addition, one measure on the ballot, Proposition 2, would allow the state to use up to $2 billion in revenue bond funds to provide housing for the homeless mentally ill. These bonds would be repaid by revenues set aside for mental health programs, not the General Fund.

This Election’s Impact on Debt Payments. We estimate that the total cost (including interest) to pay off the three general obligation bond measures on this ballot would be about $26 billion. These costs would be paid off over about 40 years, resulting in average costs of $650 million per year. This is 11 percent more than the state currently spends from the General Fund on its bond debt. The exact costs would depend on the specific details of the bond sales.

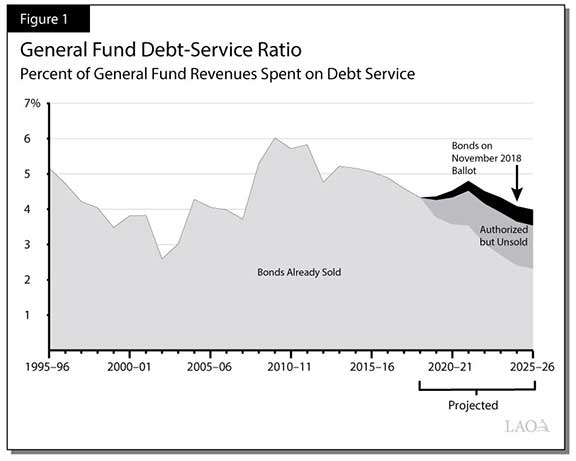

This Election's Impact on the Share of State Revenues Used to Repay Debt. One indicator of the state’s debt situation is the portion of the state’s annual General Fund revenues that must be set aside to pay for bond debt. This is known as the state’s debt-service ratio (DSR). Because these revenues must be used to repay debt, they are not available to spend on other state programs. As shown in Figure 1, the DSR is now a little above 4 percent. If voters do not approve any of the proposed bonds on this ballot, we project that the state’s DSR on already approved bonds will grow over the next few years—peaking at just over 4.5 percent in 2021–22—and then begin decreasing. If voters approve all of the proposed general obligation bonds on this ballot, we project it would increase the DSR by less than one-half of one percentage point compared to what it would otherwise have been. The state’s future DSR would be higher than shown in the figure if the state and voters approve additional bonds in the future.

Back to the Top

Back to the Top