- Home

- Propositions

- Candidates

- Justices

- Quick-Reference Guide

- Voter Information

- Political Parties

- Audio/Large Print

California General Election Tuesday, November 4, 2014

Official Voter Information Guide

Election Results

Election Results

Prop

2

State Budget. Budget Stabilization Account. Legislative Constitutional Amendment.

Analysis by the Legislative Analyst

Overview

Proposition 2 amends the State Constitution to end the existing rules for a state budget reserve—the Budget Stabilization Account (BSA)—and replace them with new rules. The new rules would change how the state pays down debt and saves money in reserves. In addition, if Proposition 2 passes, a new state law would go into effect that sets the maximum budget reserves school districts can keep at the local level in some future years. Finally, the proposition places in the Constitution an existing requirement for the Governor's budget staff to estimate future state General Fund revenues and spending. Figure 1 summarizes key changes that would occur if voters approve Proposition 2.

|

Figure 1 Summary of Key Changes That Would Occur If Proposition 2 Passes |

|---|

|

State Debts

State Reserves

School Reserves

|

Background

State Budget and Reserves

State Budget. This year, the state plans to spend almost $110 billion from its main account, the General Fund. About half of this spending is for education—principally for schools and community colleges but also for public universities. Most of the rest is for health, social services, and criminal justice programs.

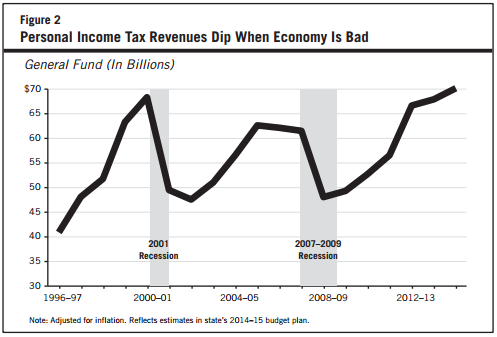

Economy Affects State Budget. Figure 2 shows state revenues from the personal income tax—the state's biggest revenue source. As shown in the figure, when the economy is bad, these tax revenues go down. When the economy improves, these tax revenues go up. Because tax revenues and reserves determine how much the state can spend, the Legislature often must take actions in bad economic years to balance the budget. These actions include spending cuts and tax increases.

“Rainy-Day” Reserves. Governments use budget reserves to save money when the economy is doing well. This means that money is saved instead of being spent on public programs during these periods of time. When the economy gets worse and their revenues decline, governments use money that they saved to reduce the amount of spending cuts, tax increases, and other actions needed to balance their budgets. In other words, if a government saves more in reserves when the economy is doing well, it spends less during that time and has more money to spend when the economy is doing poorly.

Proposition 58 of 2004. The state has had budget reserve accounts for many years. In 2004, voters passed Proposition 58 to create a new reserve, the BSA. Currently, Proposition 58 requires the Governor each year to decide whether to let 3 percent of General Fund revenues go into the BSA reserve. Right now, 3 percent of General Fund revenues equals a little over $3 billion. Under Proposition 58, this 3 percent is the "basic" amount to be put in the BSA each year. In any year, the Governor can choose to reduce the basic amount and put less or nothing at all into the BSA. Under Proposition 58, these amounts continue to go into the BSA each year until the balance reaches a target maximum, which currently equals $8 billion. (Therefore, it would take three years of the basic amount going into the account for the BSA to reach its maximum level.)

The state can take money out of the BSA with a majority vote of the Legislature. Right now, there is no limit on how much the state can take out of the BSA in a single year.

Effects of Recession on State Budget Reserves The worst economic downturn since the 1930s began in 2007, resulting in a severe recession. For several years, the state had large budget problems and took many actions to balance the budget. Because of these budget problems, California's governors decided not to put money into the BSA. California had no state budget reserves at all for several years. This year, for the first time since the recession, the Governor decided to put money into the BSA.

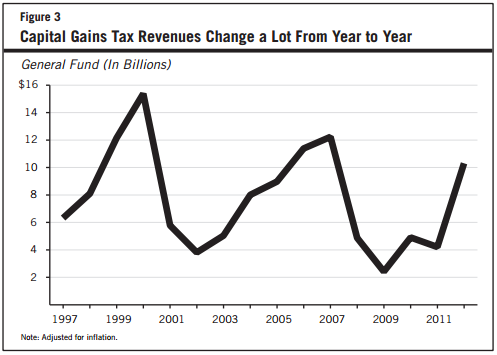

Capital Gains Taxes. As part of its personal income tax, the state taxes "capital gains." Capital gains are profits earned when people sell stocks and other types of property. Figure 3 shows personal income tax revenues that the state has collected on capital gains. Because stock prices and property values can change a lot from year to year, these capital gains tax revenues vary significantly.

School Reserves

State Spending on Schools and Community Colleges. Earlier propositions passed by voters generally require the state to provide a minimum annual amount for schools and community colleges. This amount tends to grow with the economy and the number of students. In most cases, the money that schools and community colleges get from the state makes up a large share of their overall revenues. This means that decisions made by the state can have a big effect on them. The state does not have a reserve specifically for schools and community colleges.

Local School District Reserves. State law requires school districts to keep minimum reserves, though many districts keep reserves that are much bigger than these minimum levels. For most school districts, the minimum reserve ranges from 1 percent to 5 percent of their annual budget, depending on their size. School districts save money in reserves for several reasons, such as paying for large occasional expenses (like replacing textbooks) and addressing the uncertainty in future state funding.

State Debts

The state's debts total around $300 billion. This amount includes debt for infrastructure—such as highways, school buildings, and flood and water supply projects. It also includes the following debts:

- Pension and Retiree Health Benefits. Based on official estimates, the state owes around $150 billion for pension and retiree health care benefits already earned by public employees. The state already spends several billion dollars per year to pay these costs, which have to be paid off in full over the next several decades. The costs to pay for these benefits generally will get bigger the longer the state waits to make the payments.

- Debts to Local Governments and Other State Accounts. The state also owes several billion dollars to local governments (such as school districts, counties, and cities) and other state accounts.

Proposal

Proposition 2 amends the State Constitution to change state debt and reserve practices. Figure 4 compares today's laws with the key changes that would be made if Proposition 2 passes.

|

Figure 4 Comparison of Today's Laws and Key Changes if Proposition 2 Passes |

||

|---|---|---|

| State Debt/Reserves | Today's Laws | Changes Made if Proposition 2 Passes |

| State Debts | ||

| Required extra spending on existing state debts each yeara | None.b | A minimum of $800 million. Up to $2 billion or more when capital gains tax revenues are strong.c |

| State Reserves | ||

| Basic amount that goes into the Budget Stabilization Account (BSA) each year | A little over $3 billion. | A minimum of $800 million. Up to $2 billion or more when capital gains tax revenues are strong.c |

| When can state put less than the basic amount into the BSA? | Any time the Governor chooses. | Only when the Governor calls a "budget emergency" and the Legislature agrees.d |

| How much can state take out of the BSA? | Any amount available. | Up to the amount needed for the budget emergency. Cannot be more than half of the money in the BSA if there was no budget emergency in the prior year. |

| Maximum size of the BSA | $8 billion or 5 percent of General Fund revenues, whichever is greater (currently $8 billion). | About 10 percent of General Fund revenues (currently about $11 billion). |

| School Reserves | ||

| State reserve for schools and community colleges | None. | Money would go into a new state reserve for schools and community colleges in some years when capital gains revenues are strong. |

| Limit on maximum size of school district reserves | None. | Sets maximum reserves that school districts can keep at the local level in some years. |

| a The term "state debts" includes debts for pension and retiree health benefits and specified debts owed to local governments and other state accounts. | ||

| b Proposition 58 (2004) requires that half of the money put into the BSA be used to pay down certain state bonds faster. This year’s budget is expected to pay off the rest of those bonds, meaning this requirement will no longer apply beginning with next year’s budget. | ||

| c After 15 years, debt spending under Proposition 2 becomes optional. Amounts that would otherwise be spent on debts after 15 years instead would be put into the BSA. | ||

| d Governor could call a budget emergency for a natural disaster or to keep spending at the highest level of the past three years—adjusted for population and cost of living. Note: Dollar amounts listed are in today's dollars. |

||

State Debts

Requires Spending to Pay Down Existing State Debts. Proposition 2 requires the state to spend a minimum amount each year to pay down (1) debts for pension and retiree health benefits and (2) specified debts to local governments and other state accounts. (The funds spent on pension and retiree health costs must be in addition to payments already required under law.) Specifically, for the next 15 years, the proposition would require the state to spend at least 0.75 percent of General Fund revenues each year to pay down these debts. Right now, 0.75 percent of revenues is equal to about $800 million—an amount that would grow over time.

In addition, when state tax revenues from capital gains are higher than average, Proposition 2 would require the state to spend some of these higher-than-average revenues on these state debts. Between 2001–02 and 2013–14, capital gains tax revenues were above this average roughly half of the time. The total amount that the state would spend on debts in any year could vary significantly. For instance, in years with weaker capital gains tax revenues, the state would spend $800 million to pay down debts under this proposition. In years with stronger capital gains tax revenues, the total amount could be up to $2 billion or more.

These debt payments would become optional after 15 years. If the Legislature chooses not to spend these amounts on debts after 15 years, Proposition 2 requires that they instead go into the state's BSA, as described below.

State Reserves

Changes Basic Amount That Goes Into the BSA. Each year for the next 15 years, the basic amount going into the BSA would be the same as the amount the state must spend to pay down debt, as described above. Specifically, the basic amount would range from about $800 million (in today's dollars) when revenues from capital gains tax revenues are weaker and up to $2 billion or more when revenues from capital gains tax revenues are stronger. (It can take a couple of years after the state passes its annual budget to get good information about that budget's actual level of capital gains tax revenues. Under Proposition 2, the state would have to make sure that BSA deposits reflect the most updated information on capital gains.)

Basic Amount Could Be Reduced in Some Situations. Proposition 2 changes the rules that allow the state to put less than the basic amount into the BSA. Specifically, the state could put less than the basic amount into the BSA only if the Governor calls a "budget emergency." The Legislature would have to agree to put less money into the BSA. The Governor could call a budget emergency only if:

- A natural disaster occurs, such as a flood or an earthquake.

- There is not enough money available to keep General Fund spending at the highest level of the past three years (adjusted for changes in the state population and the cost of living).

Changes Rules for Taking Money Out of the BSA.The state still could take money out of the BSA with a majority vote of the Legislature, but this could happen only when the Governor calls a budget emergency as described above. Proposition 2 also limits how much the state could take out of the BSA. Specifically, the state could take out only the amount needed for the natural disaster or to keep spending at the highest level of the past three years—adjusted for population and cost of living. In addition, if there was no budget emergency the year before, the state could take out no more than half of the money in the BSA. All of the money could be taken out of the BSA in the second straight year of a budget emergency.

Increases Maximum Size of BSA.The state would put money into the BSA until the total reaches a maximum amount of about 10 percent of General Fund revenues—which now equals about $11 billion. Once the money in the BSA reaches the maximum amount, money that otherwise would go into the BSA would instead be used to build and maintain infrastructure.

School Reserves

Creates State Reserve for Schools. When state tax revenues from capital gains are higher than average and certain other conditions are met, some capital gains revenues would go into a new state reserve for schools created by Proposition 2. Before money would go into this reserve, the state would have to make sure that the amount spent on schools and community colleges grows along with the number of students and the cost of living. The state could spend money out of this reserve to lessen the impact of difficult budgetary situations on schools and community colleges. Though Proposition 2 changes when the state would spend money on schools and community colleges, it does not directly change the total amount of state spending for schools and community colleges over the long run.

New Law Sets Maximum for School District Reserves. If this proposition passes, a new state law would go into effect that sets a maximum amount of reserves that school districts could keep at the local level. (This would not affect community colleges.) For most school districts, the maximum amount of local reserves under this new law would be between 3 percent and 10 percent of their annual budget, depending on their size. This new law would apply only in a year after money is put into the state reserve for schools described above. (The minimum school district reserve requirements that exist under today's law would still apply. Therefore, district reserves would have to be between the minimum and the maximum in these years.) County education officials could exempt school districts from these limits in special situations, including when districts face "extraordinary fiscal circumstances." Unlike the constitutional changes that would go into effect if Proposition 2 passes, this new law on local school district reserves could be changed in the future by the Legislature (without a vote of the people).

Fiscal Effects

Proposition 2's fiscal effects would depend on several factors. These include choices that the Legislature, Governor, school districts, and county education officials would make in implementing the proposition. Many of the fiscal effects of the measure would also depend on what the economy and capital gains are like in the future.

State Debts

Faster Pay Down of Existing State Debts Likely. Under Proposition 2, the state likely would make extra payments to pay down existing debts somewhat faster. This means that there would be less money for other things in the state budget—including money for public programs, infrastructure, and lowering taxes—during at least the next 15 years. Paying down existing debts faster would lower the total cost of these debts over the long term. This means that the state could spend less on its debts in future decades, freeing up money for other things in the state budget over the long term.

State Reserves

Effect of New BSA Rules on State Budget. Whether Proposition 2 would cause state budget reserves to be higher or lower over the long run would depend on (1) the economy and capital gains tax revenues and (2) decisions made by the Legislature and the Governor in implementing the measure. In some situations, for example, Proposition 2 could make it harder to take money out of the state's reserves, and this could lead to the reserves being larger over time. In other situations, this proposition could allow the state to put less in the BSA than the 3 percent basic amount specified in today's law. If Proposition 2 results in more money being put in the BSA in the future, it could lessen some of the "ups and downs" of state spending that occurred in the past.

School Reserves

Effects of State Reserve for Schools. As described earlier, certain conditions would have to be met before money would go into the state reserve for schools. Because of these conditions, money would be unlikely to go into the state reserve for schools in the next few years. In the future, money would go into this reserve only occasionally—likely in years when the economy is very good. State spending on schools and community colleges would be lower in the years when money goes into the state school reserve and higher in later years when money is taken out of this reserve.

Effects on School District Reserves and Spending. As discussed above, money likely would not go into the state reserve for schools in the next few years. Once money does go into this reserve, a new state law then would set a maximum amount of reserves that school districts could keep at the local level. In the past, most school districts have kept reserve levels much higher than these maximum levels.

If Proposition 2 passes, school districts would respond to this new law in different ways. Some districts likely would spend more on teacher pay, books, and other costs in the few years after the proposition passes in order to bring their reserves closer to the future maximum levels. Other districts might wait until after money goes into the state reserve for schools and then either (1) spend large amounts all at once to bring their reserves down to the maximum levels or (2) seek exemptions from county education officials to keep their reserves above the maximum levels.

As a result of the new state law, some districts likely would have smaller reserves the next time the economy is bad. Those districts might have to make more difficult decisions to balance their budgets at that time. If money is available in the state reserve for schools, it could help districts avoid some of these difficult decisions.

Visit http://cal-access.sos.ca.gov for details about money contributed in this contest.